How to pass a prop trading challenge on FunderPro is a question we are frequently asked and can be a game-changer for traders looking to access significant capital without risking their own funds. One of the most popular proprietary trading firms, FunderPro, is gaining traction due to its structured challenges that allow traders to prove their skills and earn funded accounts.

Passing a prop trading challenge on FunderPro, however, isn’t just about placing a few lucky trades. Success requires strategy, discipline, and preparation. In this guide, we’ll break down the key steps to help you pass the FunderPro challenge and secure funding.

What is the FunderPro Prop Trading Challenge?

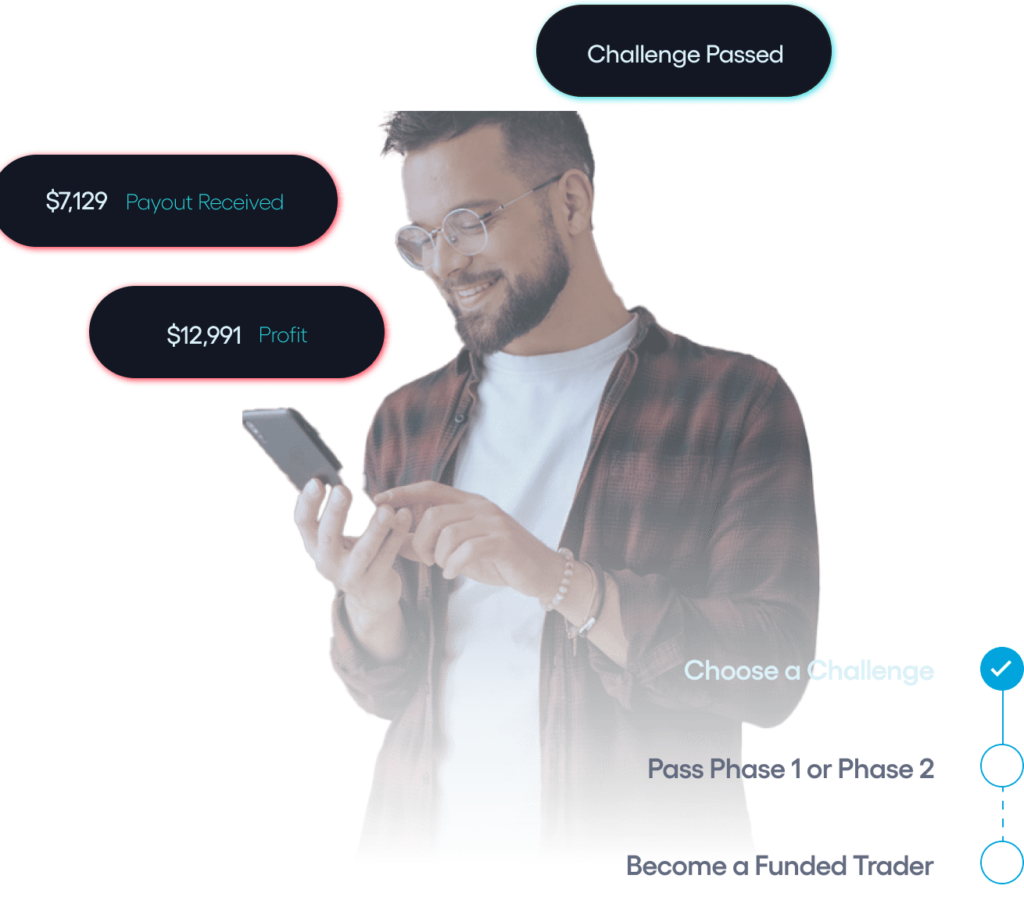

The FunderPro challenge is a two-phase evaluation process designed to test your trading skills, consistency, and risk management. The challenge ensures that only disciplined and capable traders gain access to firm capital.

Here’s a quick breakdown of the process:

- Phase 1: Profit Target and Discipline

- Achieve a set profit target (e.g., 10% of starting capital) within a defined time frame.

- Adhere to daily drawdown and maximum drawdown limits.

- Phase 2: Consistency and Risk Management

- Hit a smaller profit target (e.g., 8%) over a longer evaluation period.

- Demonstrate steady performance and control over losses.

If you meet these requirements, you’ll gain access to a funded account, enabling you to trade with the firm’s capital and retain a percentage of the profits (often up to 80%).

How to Pass FunderPro’s Prop Trading Challenge

1. Understand the Rules Inside Out

Before you even begin, thoroughly review FunderPro’s guidelines. This ensures you’re clear on key requirements such as:

- Profit targets

- Maximum daily drawdown limits (e.g., 5% of the account balance)

- Overall drawdown limits (e.g., 10%)

- Time frame for completing the challenge.

Understanding these rules helps you tailor your strategy to align with the firm’s expectations and avoid disqualification due to rule violations.

2. Develop a Clear Trading Plan

A trading plan is essential for consistent success in any trading environment. Your plan should include:

- Preferred Trading Style: Day trading, swing trading, or scalping.

- Risk Management Strategy: Define your risk per trade (e.g., 1-2% of account balance).

- Entry and Exit Criteria: Use specific setups and indicators, such as moving averages, Fibonacci retracements, or candlestick patterns.

- Market Focus: Choose a specific asset class, such as forex pairs, indices, or commodities.

Your trading plan ensures that you remain disciplined, minimizing the temptation to deviate from your strategy during emotional highs or lows.

3. Master Risk Management

Prop trading firms like FunderPro emphasize risk management because it reflects a trader’s discipline and consistency. To pass the challenge:

- Set a Stop-Loss on Every Trade: Protect yourself from excessive losses.

- Use a Fixed Risk Percentage: Risk only 1-2% of your account per trade to avoid breaching the drawdown limit.

- Avoid Overtrading: Stick to high-probability setups and avoid revenge trading after a loss.

For example, if your account balance is $50,000 and you risk 1% per trade, your maximum loss per trade is $500. This approach ensures you can endure a streak of losses without jeopardizing the challenge.

4. Focus on Consistency, Not Just Profitability

Consistency matters as much as achieving the profit target. Here’s how to demonstrate consistency:

- Stick to Your Strategy: Don’t hop between strategies if you encounter a few losses.

- Maintain Position Size: Avoid sudden spikes in lot sizes; this indicates recklessness.

- Avoid Large Drawdowns: A steady equity curve is more impressive than one marked by extreme peaks and valleys.

Prop trading firms value traders who can generate steady returns over time rather than gamblers chasing short-term wins. Learn more about FunderPro’s consistency rule here

5. Backtest Your Strategy

Before starting the FunderPro challenge, backtest your trading strategy using historical data. This helps you:

- Identify its profitability and win rate.

- Understand its drawdown behavior.

- Build confidence in its effectiveness.

For instance, if you primarily trade forex, use a demo account or a simulator to test your approach in various market conditions. This preparation ensures you’re ready for the live trading environment.

6. Maintain a Trading Journal

A trading journal is a powerful tool for evaluating your performance and identifying areas for improvement. Record the following for every trade:

- Entry and exit points

- Position size

- Profit or loss

- Emotions during the trade

Review your journal regularly to spot patterns, refine your strategy, and eliminate costly mistakes.

7. Optimize Your Psychology

Passing a prop trading challenge is as much a mental game as it is a technical one. Traders often fail due to psychological pitfalls like overconfidence, fear of losing, or impatience.

Here’s how to maintain a winning mindset:

- Stay Patient: Focus on gradual progress rather than rushing to meet the profit target.

- Detach from Outcomes: Treat each trade as just one in a series, without fixating on individual wins or losses.

- Manage Stress: Incorporate mindfulness or exercise to stay calm during high-pressure moments.

8. Use the Trial Period Wisely

FunderPro often provides a demo or trial phase where you can practice without real consequences. Use this opportunity to:

- Familiarize yourself with the platform.

- Test your strategy in a simulated environment.

- Ensure you can consistently stay within the firm’s rules.

This risk-free practice phase boosts your confidence when transitioning to the actual challenge. By following these tips, passing the prop trading challenge on FunderPro becomes a much more achievable goal.

Common Mistakes to Avoid in the FunderPro Challenge

- Neglecting the Rules: Ignoring drawdown limits or time frames can lead to disqualification.

- Overleveraging: Using excessive position sizes increases the risk of breaching drawdown limits.

- Revenge Trading: Emotional trading after a loss often leads to spiraling losses.

- Skipping Preparation: Starting the challenge without backtesting or demo practice is a recipe for failure.

What Happens After You Pass?

Once you pass the FunderPro challenge, you’ll gain access to a live funded account. At this stage, your focus should shift to scaling profits while maintaining discipline. Remember that your performance will continue to be monitored, so keep adhering to the firm’s risk management rules.

Conclusion

Passing the FunderPro prop trading challenge requires a blend of preparation, discipline, and a solid trading plan. By understanding the rules, practicing effective risk management, and staying consistent, you can increase your chances of success and unlock the potential of trading with firm capital.

Take your time to prepare, refine your strategy, and keep a level head. With these steps, you’ll be well on your way to achieving your prop trading goals with FunderPro.

Good luck, and happy trading!